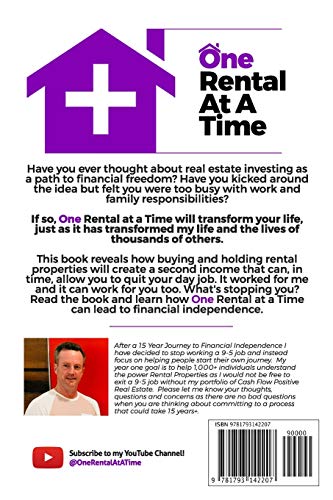

Independently Published One Rental at a Time: The Journey to Financial Through Real Estate

N**W

One man's journey to financial freedom, documenting the journey through real estate investing

Michael documents his personal journey in an entertaining manor showing the reader how it is possible to go from a W-2 Employee to having the freedom to run your own business. The reader has a unique insight into how to begin investing in the first single family home, studying different markets, the pitfalls of acquiring banks loans, and methods to seek capital using other peoples money.I appreciated the chapters related to the downturn in the market from 2008-2011, which required a change in investment strategies to cope with the shifting market conditions in the banking industry. The other aspect of the book in which I liked was the thought process involved to feel comfortable in your real estate business enough to quit your corporate job.The last section of the book provides real life examples for which applies to almost any region in the USA to apply these same principles to your own circumstances to achieve the same result. Michael has created much free content associated with the One Rental At A Time theme which I follow to keep up with his journey and knowledge in the real estate business. I feel his interest to help others is genuine, and look forward to learning more content as I explore the next step in my own journey toward financial independence.

M**L

Great book on how to get started on your property journey in the rental business.

Some good ideas on how to make it successful in the rental market.

E**Y

Fantastic

Fantastic read. Very motivation and practical

C**N

sound investment strategy

I find that any research or reading you do, you should come away with one or two ideas of how to apply them to your own situation. This book did that for me. I live in British Columbia and our markets are very different than that of the USA. However, the fundamentals are still there. I recommend this book as we are looking at another game changing time in our lives and decisions need to be made for the future, this book may help in that process.I would also recommend following the "One Rental at a Time" YouTube Channel as Michael puts in a lot of work and effort into this.

G**A

Reality Check

Awesome book that provides author's journey and tips along the way! I prefer learning about people's mistakes and get straight into success when it comes to my own real estate investing path. It is always helpful to learn from others journies. Good motivational book very helpful!!

D**Y

Reads like a drunken bar story

Overall, this is a fairly interesting, but meandering, self-published (and un-edited) story that's hard to follow, not applicable to most new investors, and leaves out critical pieces of information that a new or hopeful real estate investor should know.CONTEXTI'm a new-ish investor that owns 1 duplex with the goal of expanding that to 10 in over the next 12 years before an aggressive pay-down period. I've read a handful of good books, and also come from a family of real estate investors (but I'm financing my own purchases from my day job). The title of this book struck me because it reflects my current strategy of buying 1 solid building at a time with a reasonable down payment, and holding it forever. It also got almost perfect reviews, so I went for it. Here's what I think it falls short:NOT TYPICAL SITUATIONSThe author talks about the struggles of his first property, which was a very relatable moment — we've all had tenant problems, but then he goes on to explain how the economic collapse led to a massive buying opportunity. Furthermore, he made LOADS of money from his day job. Before the economic recession, he was buying a new property and paying out-of-pocket "make ready" costs every 6 months! I don't have 50-80K to invest every 6 months! In the housing recovery, he was buying a new property every single month!! AND working full-time. While those were stellar buys, he was also coughing up 5-figures per month to make it work. Honestly, he could have invested that money in a very secure, 5% returning hedge-fund, or other managed fund, and retired with a permanent & secure 6-figure income over the span of his investing career. Most new investors need to make thoughtful, strategic purchases and can't afford to purchase an absolute torrent of properties, one after the next. He also didn't have a clear buying strategy laid down. He just kept buying one after the next without marking progress or assessing the performance of his buildings. It'd be very helpful to know how a seasoned investor assess the performance of his or her buildings, but we're not getting that from this book.MISSING DETAILSAt one point in the book, he makes reference to not taking excuses from his tenants who don't pay rent (and I agree), but he also ended with hundreds of doors. Was he self-managing his own properties that whole time? Did is partner manage them? Did he hire a property management company? Did he directly hire and build a private team? Did his management strategy evolve as acquired more properties? These are critical questions to the full-time employee investor. After reading the book, I don't have any clue. He also says that this isn't a financial book, which I can appreciate, but its absolute lack of financial info leaves me wanting more details. What was his buying criteria? He tried for the 1% rule (monthly rent should be equal to 1% of the asking price), but he didn't talk about his fall-back plan. It's not as clear as many other books. And what about buying in gentrifying neighborhoods vs established ones? Furthermore, he straight-up dismisses buying out of state, which is the only option for many people living in places like NYC and San Fran.Another point he makes in the book is the critical importance of not spending your emergency fund that you have allocated for each building, but that's literally all that he says about it! Some lenders require reserves of 6-months rent per building that you own, but he doesn't tell you that. He doesn't say anything about how much to save, how much (on average) you'll have to spend or why — he simply tells you not to blow that money on new property acquisitions.RUDDERLESS & MEANDERINGI found the last chapters frustrating because he was able to retire, but his goals are still largely undefined. He keeps talking about selling his buildings to pay down his single family homes as an option, but why? Do they offer better returns? What are the other options, such as the snowball pay-down method? Why not pay down all of the mortgages and live on a fraction of his income while he does so? What are the financial implications of each option? The one clear message I took away is that you don't have to know a ton to do well in real estate.FIND A MENTORInstead of reading this book, I think it would be better to ready literally any other investing book (especially those written by the Deeper Pockets crew), or to get drinks or coffee with a seasoned investor who's 2 steps ahead of you. Sadly, it's just his story, which is interesting, and you can glean bits of knowledge from it, but other books or real mentors will set you up far, far better.

Trustpilot

1 day ago

2 weeks ago